State governments have introduced energy saving schemes to help incentivise businesses to implement initiatives into their business that reduce energy consumption and their carbon footprint. These schemes aim to provide financial benefits such as certificates, rebates, discounts and vouchers for businesses to help lessen the initial financial burden of these energy efficiency investments.

In order to harness the benefits of energy saving schemes you first need to know what schemes are available in your state. Read more to learn how you can use these incentives to make the most of your energy savings.

Energy Saving Schemes in Victoria

Victorian Energy Upgrade (VEU)

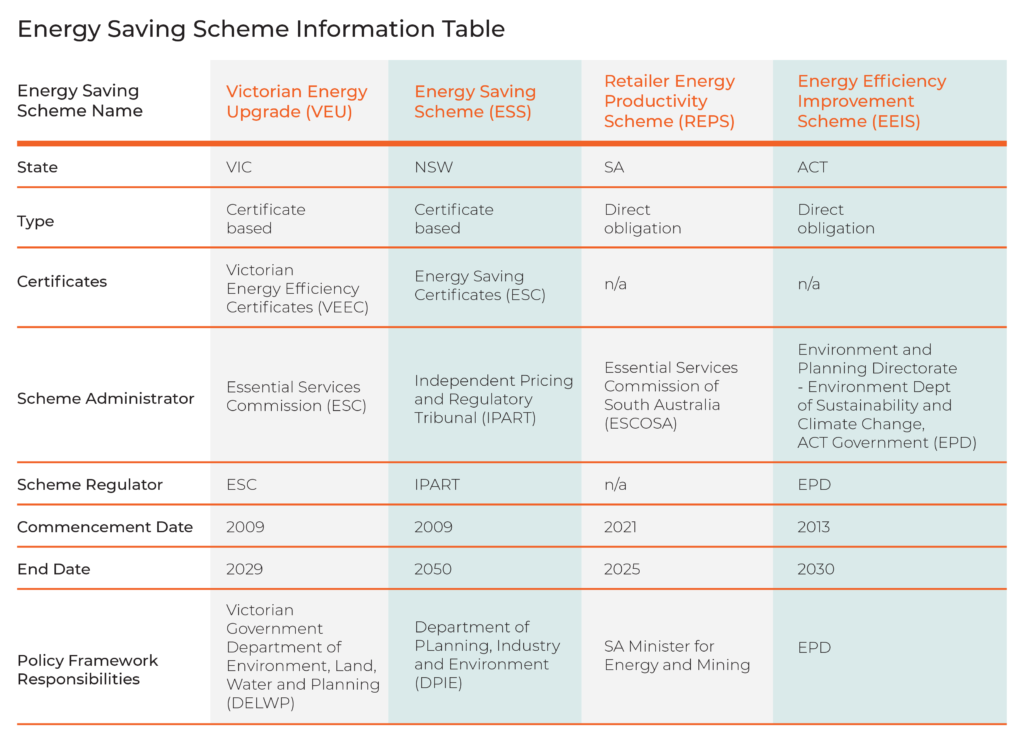

The Victorian Energy Upgrade (VEU) program which was established by the Victorian Energy Efficiency Target Act 2007 (Act) commenced on January 1st 2009 and ends on December 31st, 2029. Under this program, Victorian Energy Efficiency Certificates (VEECs) were introduced as a way to provide financial incentives for businesses. They are created when one tonne of greenhouse gas emissions are reduced from energy efficiency activities offered under the scheme are completed.

Once VEECs are created they can then be sold to eligible energy retailers who are required, under the program, to surrender a certain amount of certificates each year. As energy certificates are traded on an open market, their prices differ drastically depending on the market situation. Currently, VEECs are trading for around $52 according to Green Energy Trading.

Creation of VEECs

VEECs can only be created by those accredited by the Essential Services Commission (ESC) under the VEU program. Once accredited, those parties are able to create VEECs online through their VEU account. These certificates must be created within 6 months after the year of the activity being completed. For example, if an activity was completed on July 20th 2020, then the VEECs must be created before June 30th 2021.

Accredited persons may be required to surrender certificates if they are found to have improperly created certificates. Typically the accredited persons charge 20% to 30% of the totals VEECS created for project based activities

Registration

Once certificates have been created, they must go through a registration process, which costs $1 per certificate, to assess whether the certificate was created in accordance with the rules. Once this process is completed the certificates are officially registered and can be either transferred or surrendered.

Benefits for VIC businesses

Creating and selling VEECs allows businesses to generate extra revenue to help support the cost of their energy efficient practises. It also lowers the overall energy cost of the business as they will be using energy more efficiently.

Energy Saving Schemes in New South Wales

Energy Saving Scheme (ESS)

The Energy Saving Scheme (ESS) is a program created under Division 7 of Part 9 of the Electricity Supply Act 1995 to help promote energy-efficient practices commenced January 1st 2009 and is set to end in 2050 or until there is an equivalent national energy efficiency scheme. From this program, Energy Saving Certificates (ESC) were created which are tradable certificates that represent one notional megawatt-hour of energy that was created under the Energy Saving Scheme.

Selling ESCs

Accredited certificate providers are able to trade certificates with a buyer for monetary compensation. Currently, contracts and prices may vary as there is no standard or recognised exchange for trading these contracts. The price of these contracts depends heavily on market conditions with prices currently around $38.25.

However, the Independent Pricing and Regulatory Tribunal (IPART) and the ESS are aware that there are currently three different types of contracts for trading ESCs. These contracts are a spot contract, forward contract and options contract.

IPART is both the scheme regulator and scheme administrator of the energy savings scheme. They are not involved with market transactions and negotiations for ESC as they purely watch and regulate the creation of the certificates.

Benefits for NSW businesses

The ESS provides businesses with financial incentives to upgrade equipment and processes in order to improve energy efficiency. These upgrades also lead to lower overall energy costs as the businesses will be using less energy from their efficient practises.

Energy Saving Schemes in South Australia

Retailer Energy Productivity Scheme (REPS)

The Retailer Energy Productivity Scheme (REPS) aims to provide South Australian households and businesses energy-saving incentives to reduce their energy consumption and lower their carbon footprint. This is achieved through setting energy productivity targets (EPTs) that electricity and gas retailers must meet. Retailers offer desirable incentives to both households and businesses to encourage smart energy usage and boost energy-saving activities within homes and business premises.

REPS commenced on January 1st 2021, and will end on December 31st 2025, and was the successor to the Retailer Energy Efficiency Scheme (REES) which ran from January 1st 2009 to December 31st 2020. REES was for residential only whereas REPS is now inclusive of residential and commercial to focus on improving the productivity of energy through demand shifting and response management capabilities, as well as improving energy efficiency.

Benefits for SA businesses

Benefits include discounts on services fees, cash rebates, vouchers, free products (up to a certain value) etc.

Energy Saving Schemes in Australian Capital Territory

Energy Efficiency Improvement Scheme (EEIS)

The Energy Efficiency Improvement Scheme (EEIS), introduced by the ACT Government, is a scheme that places a requirement on energy retailers to encourage and achieve energy savings in both households and businesses. Similar to the REPS these retailers have a target they have to reach in order to ensure that energy-saving objectives are satisfied. Furthermore, new insulation and business heating and cooling activities have also been introduced to the scheme to further encourage energy efficiency. The EEIS has been set to end at the end of 2030.

Benefits for ACT businesses

EEIS helps businesses save energy and reduce costs by encouraging them to switch to more energy efficiency products.

How can your business take advantage of these energy saving schemes?

Selecting and implementing the most cost-effective and optimal energy saving strategy for your business doesn’t have to be a daunting task. With the various energy saving schemes available to help with financing your energy saving opportunities, there’s no better time to start than now.

Whether you are a large, medium or small business there are many energy saving strategies you could be undertaking. This could include practices such as lighting upgrades, HVAC upgrades, office appliances and equipment upgrades.

Each building is unique and presents its own energy saving opportunities. If you would like tailored recommendations on how you can optimise energy consumption and maximise your energy savings contact us today. Our professional energy auditors are able to identify and make recommendations to save more on your energy costs.

In Summary

Many companies are already undertaking energy saving initiatives in their buildings or are looking to do so but are concerned with the financial costs. By utilising these listed energy saving schemes to your advantage you will be able to get more out of the energy you save. Of course financial incentives are only half the benefits that come along with these energy saving schemes. As a result of companies and their energy saving programs, Australia will be able to drastically lower its annual energy consumption and reduce greenhouse gas emissions as we move towards net zero and a more sustainable future.

Towards Net Zero

We’re building a future towards net zero carbon emission assets. Fund your project through energy savings and start achieving your net zero and NABERS rating goals today.

Get in touch